With college tuition costs at an all-time high and still rising, financing a degree can seem overwhelming. Most students turn to loans, and nearly 92% of U.S. student debt is managed by the U.S. Department of Education. Exploring federal loan options can offer a solution, but understanding how these loans work is crucial for planning. Choosing the right loan could mean repaying only what you borrowed or significantly more due to accrued interest.

If you’re considering federal loans, it’s essential to know the types available. Two primary options are subsidized and unsubsidized loans, often called federal direct loans. Here’s an in-depth look at each, so you can make an informed choice that suits your financial needs.

What Are Subsidized Loans?

Subsidized loans are part of the Federal Direct Loan Program and are specifically for undergraduates with demonstrated financial need. To qualify, you must complete the Free Application for Federal Student Aid (FAFSA), which assesses your financial situation. One of the key advantages of subsidized loans is that the federal government covers the interest while you’re in school at least half-time, during deferment, and for the first six months after you graduate. This “grace period” can save you hundreds, or even thousands, in interest over the life of the loan.

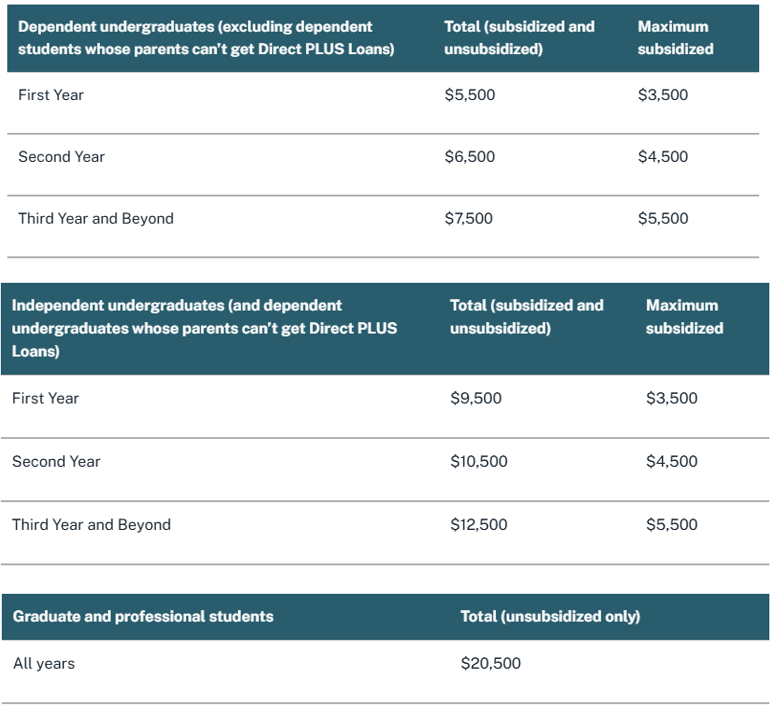

For example, a first-year undergraduate student classified as dependent can borrow up to $3,500 in subsidized loans. As you advance through school, borrowing limits increase. Second-year students may qualify for up to $4,500, while third- and fourth-year students are eligible for up to $5,500 annually. The total limit for subsidized loans throughout your education is capped at $23,000, which helps keep overall borrowing manageable.

Key Points on Subsidized Loans

- Eligibility: Demonstrated financial need through FAFSA.

- Borrowing Limits: Yearly limits increase with academic progression, first-year students can borrow up to $3,500; second-year, $4,500; third- and fourth-year, $5,500.

- Aggregate Limit: $23,000 total for undergraduates.

- Michigan-Specific Aid: Michigan residents may qualify for state grants or scholarships, reducing the need for loans.

What Are Unsubsidized Loans?

Unsubsidized loans, also part of the Federal Direct Loan Program, are available to both undergraduate and graduate students and do not require demonstrated financial need. Unlike subsidized loans, interest starts accruing on unsubsidized loans from the moment funds are disbursed. This means that interest builds up while you’re in school, during deferment, and through the grace period. Students are not required to pay on the interest while they are in school, but have the option to start paying down the interest if they want. If they don’t, then the interest is added to the balance owed on the loan.

Unsubsidized loan limits

.Here’s how the loan limits for unsubsidized loans work:

- For dependent first-year students: The total loan limit is $5,500, which includes both subsidized and unsubsidized loans.

- If you receive $3,500 in subsidized loans, you can borrow up to $2,000 in unsubsidized loans.

- If you don’t receive any subsidized loans, you can borrow the full $5,500 as unsubsidized.

- For independent first-year students: The total loan limit is $9,500, including both types.

- If you receive $3,500 in subsidized loans, you can borrow up to $6,000 in unsubsidized loans.

- If you don’t receive any subsidized loans, you can borrow the full $9,500 as unsubsidized.

These limits may increase as you progress through school.

Key Points on Unsubsidized Loans

- Eligibility: No financial need required.

- Borrowing Limits: Based on attendance costs and other aid, first-year students up to $5,500 for dependents, with higher limits for independent students.

- Aggregate Limit: Dependent students can borrow up to $31,000; independent students, $57,500.

- Graduate Student Limits: Graduate students can only qualify for unsubsidized loans in an amount up to $20,500 annually, with a lifetime limit of $138,500.

Here’s a quick overview of these limits to help you understand what’s possible at each stage:

- Dependent Students: First-year limit of $5,500 for unsubsidized loans, increasing each year.

- Independent Students: Higher limits, starting with $9,500 for first-year students.

Loan Limits Overview

Here’s a summary of annual and total loan limits to help you plan your finances:

These limits give you a clear picture of how much funding is available each year and can help you plan your borrowing accordingly.

Qualifying for Federal Loans

Your journey to federal loans begins with submitting the FAFSA, which gathers data on your financial status. Grace Christian University’s financial aid office then reviews this data to create a customized aid package that includes loans, and grants.

- Subsidized Loans: Available only to undergraduates who demonstrate financial need.

- Unsubsidized Loans: Available to both undergraduates and graduate students, regardless of need.

Applying for Federal Loans: A Step-by-Step Guide

Applying for these loans is straightforward:

-

- Complete the FAFSA: Start by completing the FAFSA, the gateway to all federal aid.

- Review Your Financial Aid Package: Grace Christian University’s financial aid team will assess eligibility and present available options.

- Accept the Loan Amount You Need: Only borrow what you need, you’re not obligated to accept the full offer.

- Sign the Master Promissory Note (MPN): This legally binding document outlines your repayment obligations.

- Complete your Loan Entrance Counseling: Before receiving your first federal loan, complete Loan Entrance Counseling through the Department of Education to understand your repayment responsibilities.

Loan Repayment Options After Graduation

After graduation or if you drop below half-time enrollment, you have a six-month grace period before payments begin. Department of Education offers loan counseling to support your repayment planning:

- Standard Repayment: Fixed monthly payments over ten years, minimizing interest costs overall.

- Income-Driven Repayment Plans: Monthly payments are adjusted based on discretionary income.

- Public Service Loan Forgiveness (PSLF): If you work in public service, you may qualify for loan forgiveness after ten years of qualifying payments.

Strategies to Minimize Student Debt

Reducing debt while in school can ease the repayment burden later. Consider these tips:

- Pay Interest on Unsubsidized Loans While in School: Reducing interest while in school can prevent your balance from growing.

- Focus on Grants and Scholarships First: Grants and scholarships don’t require repayment, decreasing loan dependency.

- Explore Work-Study Programs: Eligible students can earn funds to offset educational expenses.

Michigan residents may also qualify for additional state scholarships or grants. Check with Grace’s financial aid office for assistance in exploring these options.

Grace Christian University’s Commitment to Affordable Education

Grace Christian University is dedicated to making education affordable by emphasizing transparency in tuition and available financial aid. We work closely with students to maximize support and reduce loan dependency wherever possible, paving the way for successful, debt-conscious careers.

Our financial aid office is here to help guide students through borrowing, interest rates, and repayment options. By understanding the costs and benefits of loans now, you can ease future financial strain. Given Michigan’s average student loan debt of $30,000, Grace is committed to minimizing student debt, with an affordable pathway to education that encourages minimal borrowing.

With the right financial plan, you can graduate without being burdened by debt. Let Grace Christian University’s resources guide you toward this goal, empowering you to graduate with confidence.

Conclusion

In conclusion, both subsidized and unsubsidized loans offer essential support, especially for Grace students. Knowing the differences between them can help you make smarter financial decisions. Grace Christian University combines federal aid resources with a commitment to affordability, helping students achieve their academic goals with confidence. For personalized support, reach out to Grace’s financial aid office for guidance on FAFSA, loan choices, and repayment plans tailored to your needs.